Having a good credit score is essential for many aspects of your financial life. Whether you’re looking to buy a home, get a car loan, or even apply for a credit card, having a high credit score can make a big difference in the interest rates and terms you’re offered. If your credit score is less than stellar, don’t worry – there are proven strategies you can use to boost your credit score and improve your financial health.

1. Pay Your Bills on Time

One of the most important factors that affect your credit score is your payment history. Making on-time payments is crucial for maintaining a good credit score. If you have a history of late payments, it can have a negative impact on your credit score. To boost your credit score, make sure you pay all your bills on time, every time. Set up automatic payments or reminders to help you stay on track.

2. Reduce Your Credit Card Balances

Another factor that affects your credit score is your credit utilization ratio, which is the amount of credit you’re using compared to the amount of credit you have available. To boost your credit score, aim to keep your credit card balances low. Ideally, you should aim to keep your credit utilization ratio below 30%. Paying down your credit card balances can help improve your credit score.

3. Don’t Close Old Accounts

Closing old accounts can actually hurt your credit score. The length of your credit history is an important factor in determining your credit score. If you close old accounts, it can shorten the average age of your accounts, which can lower your credit score. Instead of closing old accounts, consider keeping them open and using them occasionally to keep them active.

4. Check Your Credit Report Regularly

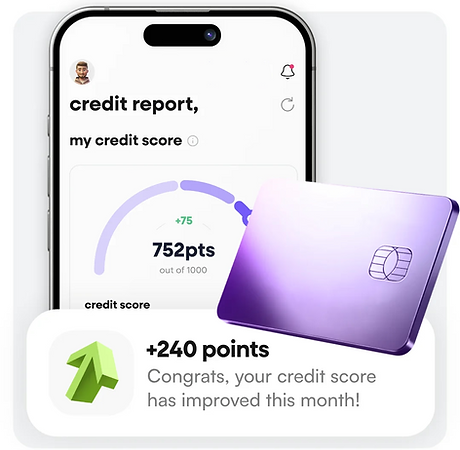

It’s important to regularly check your credit report for errors or inaccuracies that could be dragging down your credit score. You’re entitled to a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – every year. Review your credit report for any errors and dispute any inaccuracies you find. Keeping an eye on your credit report can help you catch and correct any issues that could be hurting your credit score.

5. Use Credit Wisely

Finally, to boost your credit score, use credit wisely. Avoid opening too many new accounts at once, as this can lower your average account age and hurt your credit score. Be strategic about the types of credit you apply for and only apply for credit when you need it. By using credit responsibly, you can boost your credit score over time.

In conclusion, boosting your credit score is possible with the right strategies. By paying your bills on time, reducing your credit card balances, keeping old accounts open, checking your credit report regularly, and using credit wisely, you can improve your credit score and set yourself up for financial success. Boost credit score and take control of your financial future.

For more information visit:

Free Credit Repair | Credit Rescored | Boost 200 Points

https://www.creditrescored.com/

Glendale – California, United States

Boost your credit score fast with expert dispute strategies. Get free dispute letters, DIY credit repair kits, or full-service restoration. Fix your credit with Experian, Transunion, and Equifax today at Credit Rescored.